Macdonald Campus Magazine tells the story of life in wartime Canada - McGill ReporterMacdonald Campus Magazine tells the story of life in wartime Canada

Digital archives allow readers to travel back in time more than 100 years

By Neale McDevitt

Editor, McGill Reporter

November 11, 2021

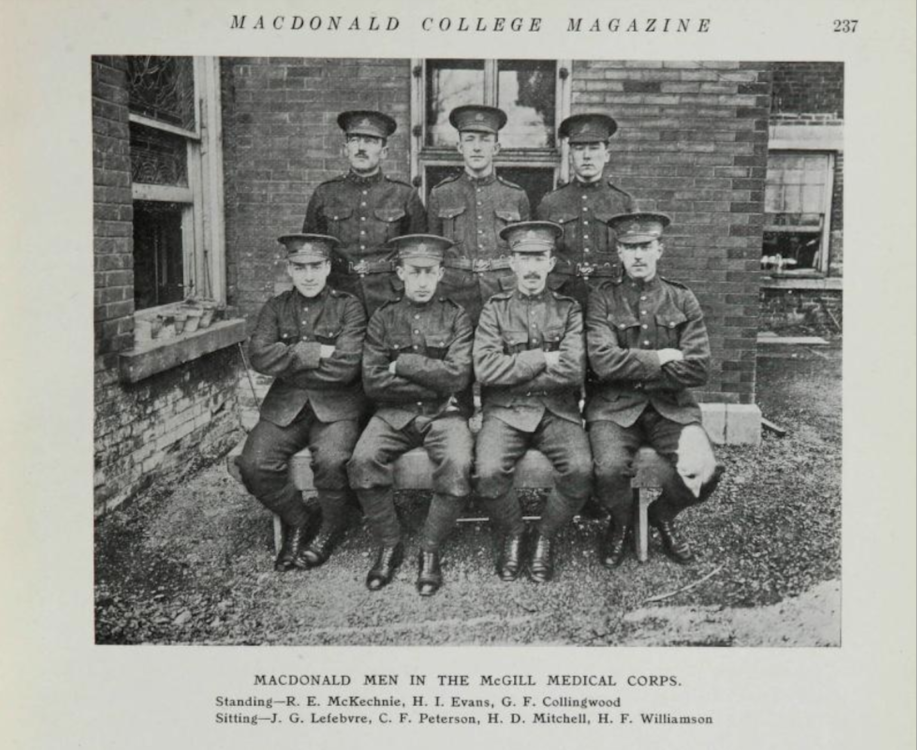

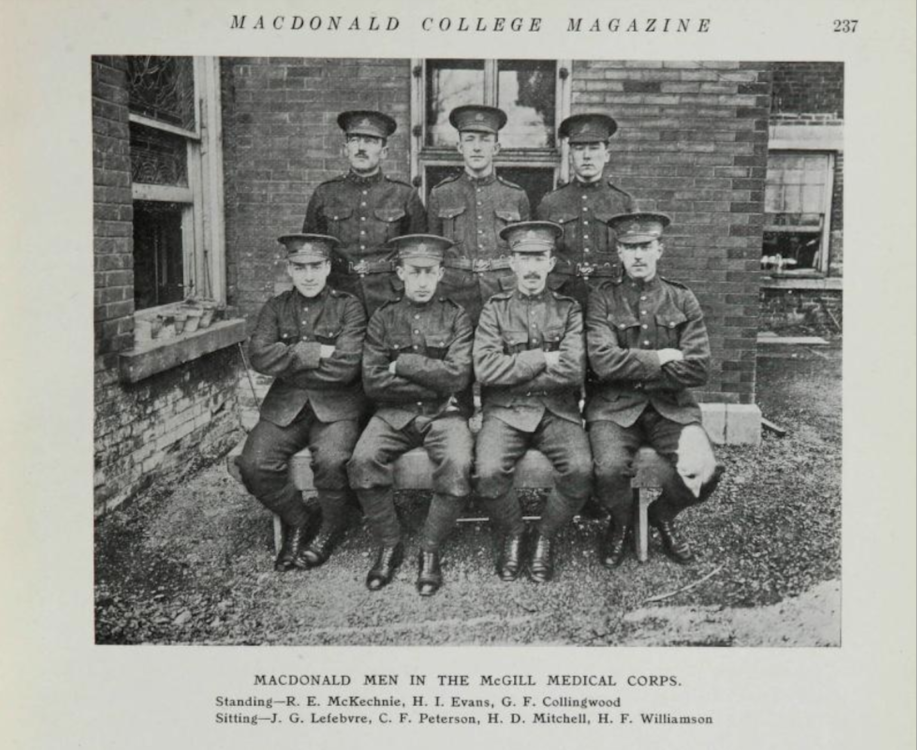

Members of Macdonald College who had enlisted in the McGill Medical Corps. From the February-March 1915 issue of Macdonald Campus Magazine

A quick scan of the table of contents of the

October-November 1914 issue of the Macdonald College Magazine, reveals articles one would expect in a publication produced by an agricultural college that also trained teachers. Progressive Farming in Sherbrooke County, Preparing the Flock for Winter, and Music in the Curriculum are typical of the indexed headlines.

However, on Page 5, a headline unlike any other in the magazine’s (then) four-year history jumps off the page.

If War Broke Out!, written by Maurice C. Signoret, asks readers to consider the outcome of a hypothetical war between France and Germany.

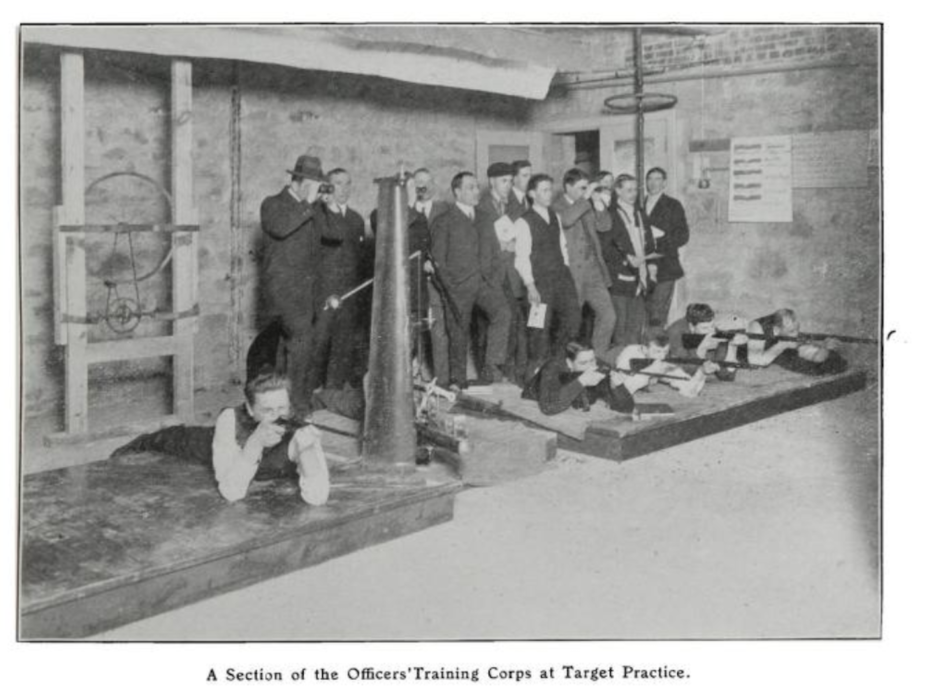

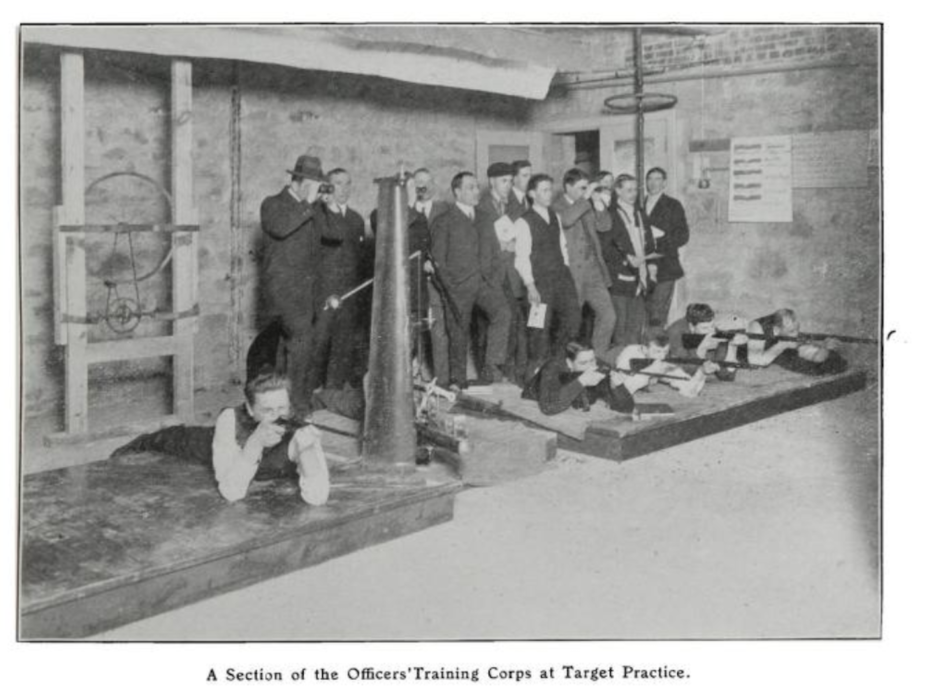

Members of Macdonald College take target practice as part of the on-campus Officers’ Training Corps

The article ends with Signoret’s chillingly accurate prediction “What will occur in this dreadful contact, in which more than 23 millions of men will take part!” writes Signoret, an Agriculture student at the time. “What will be the hideous butchery, outrage to humanity, the horrible slaughter, to which this fantastic mixtion [sic] will give way, seconded as they will be by frightful engines of artillery, engines of ruin which will make hecatombs of corpses! A terrifying, unimaginable, and, though fatal, unavoidable war, where nations will be dashed by the shock, and in which the revolution, everywhere prepared, will sweep away emperors, kings, their servitors, and the society responsible for such catastrophes!”

Of course, the First World War started on July 28, 1914, several months before the issue was published, and much of Europe was already reeling under the impact of the conflict. However, as clarified in the

Editor’s Note, the article was submitted even before war had been declared.

“This article was written last spring by Mr. Signoret for our magazine. Little did we think when he wrote it how terribly true were his words,” noted the editors. “In fact we did not publish it partly because we did not think it best to even hint at such a dire event. He is a Frenchman, and this article has been left for the most part in the original language in which he wrote it. To-day he is nobly fighting for our liberty at the front. May Heaven bring him back to us safe and sound!”

With that, the Macdonald College Magazine added a new beat to its coverage, chronicling the impact of war upon campus life and local and national agriculture, and keeping tabs on the members of its community who had signed up to serve.

Step back in time

To sift through the

digital archive of those early wartime issues page by page is to take a fascinating jorney back in time.

Browsing the war year issues, readers will find classic Macdonald College Magazine fare (The Industrial Use of Potatoes) intermingled with news about the war and, in particular, the members of Macdonald College who had enlisted.

“In the fall number of the MAGAZINE we had the honour of inscribing on its pages the names of those who had volunteered for active service in the cause of the Empire. Many of those whose names were given are now doing their part, as we knew they would, in the trenches in France, or in other capacities in keeping with their training and the necessities of war… it behooves us to realize that Macdonald Campus now has representatives in the actual theatre of war,” begins an article titled

Macdonald’s Roll of Honour, published in the February-March 1915 issue.

The article captures the closeness of the small Mac community and the pride the members of the College felt for their colleagues overseas. “Not long ago the Principal received a letter from Baily, in which a very vivid account of the life with the mighty army was detailed. MacClintock has also given us, in his usual racy style, an account of things in his own sphere… We honour our boys who for the time being have discarded the pen, the test-tube and the lecture-room to don the khaki of the King, and we await with confidence their return from the field of honour, and of glory. Their sacrifices have been great; great will be their reward.”

The reality of war

Of course, the sacrifices were great.

In all, 357 members of Macdonald College served in the First World War. Thirty-four did not come home.

The October-November 1916 issue of the Magazine News carried tragic news. Three members of the Mac community had been killed in Europe – the first such losses for the College.

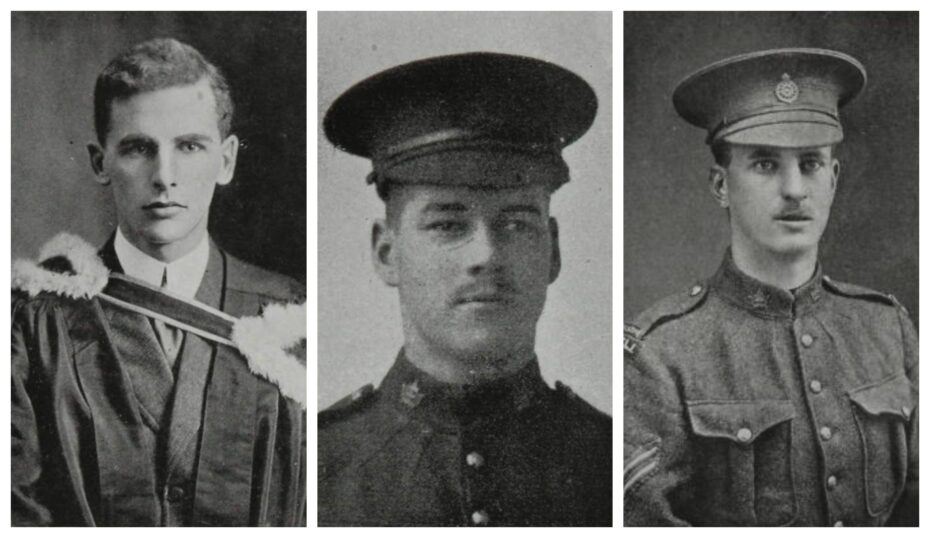

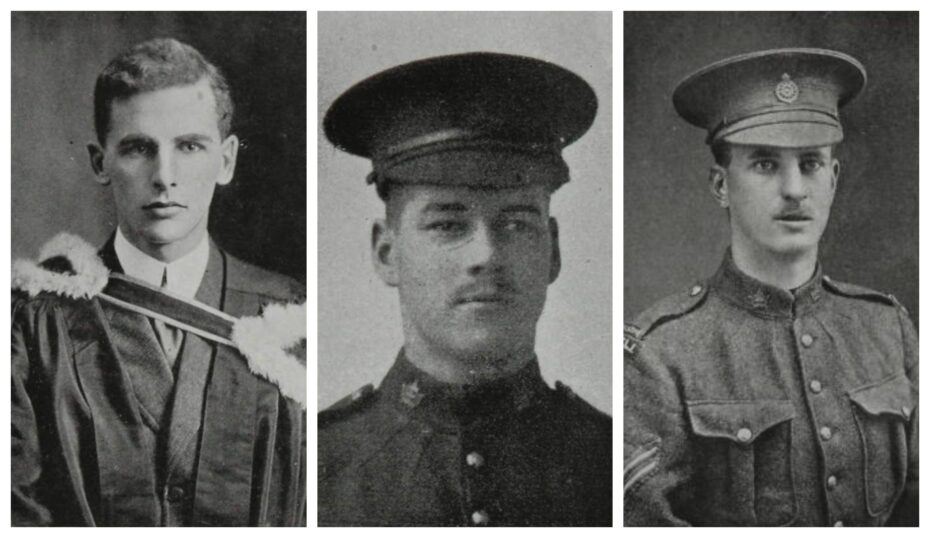

From left to right: W.D. Ford, Julius G. Richardson and James H. McCormick were the first three members of Macdonald College to be killed in action during the First World War

W.D. Ford (BSA’13), was described as “one of the most promising men in his class,” in the

Magazine’s obituary, and “one of those rare beings whose keen eyes found no difficulty in descrying the path of duty, whose inherent honesty and nobleness of character permitted him to deviate no hair’s breadth from this path.” A lance corporal in the Canadian Infantry (Eastern Ontario Regiment), Ford, was killed in action at Sanctuary Wood in Ypres on June 2, 1916.

Julius G. Richardson was also killed in Ypres, but on June 7, 1916. Richardson had put his Agriculture degree on hold to enlist, serving as private with the 24th Battalion, Canadian Infantry (Quebec Regiment). “It is difficult for us to realize that our College chum and true friend to all who knew him, will never return,” reads the

obituary. “We all looked forward to his coming back to complete his course at Macdonald with us.”

A sergeant in the Princess Patricia’s Canadian Light Infantry (Eastern Ontario Regt.), James H. McCormick, was killed during the Battle of the Somme on September 15, 1916. “Probably no student who has attended this institution had any quicker insight into the intricacies of a subject than he,” says the

Magazine’s obituary. “His ability to tell a good story, his jolly laugh, his willingness at all times to help a fellow student through some difficult phase of physics or chemistry, helped him win a multitude of friends, and many a happy hour was spent in his company.”

Read the

Macdonald College Magazine / Journal digital archives online, including the issues spanning World War II.

Members of Macdonald College who had enlisted in the McGill Medical Corps. From the February-March 1915 issue of Macdonald Campus Magazine

Members of Macdonald College who had enlisted in the McGill Medical Corps. From the February-March 1915 issue of Macdonald Campus Magazine Members of Macdonald College take target practice as part of the on-campus Officers’ Training Corps

Members of Macdonald College take target practice as part of the on-campus Officers’ Training Corps From left to right: W.D. Ford, Julius G. Richardson and James H. McCormick were the first three members of Macdonald College to be killed in action during the First World War

From left to right: W.D. Ford, Julius G. Richardson and James H. McCormick were the first three members of Macdonald College to be killed in action during the First World War